10 200 unemployment tax break refund status

The American Rescue Plan Act which was signed on March 11. Jobless Americans get a tax waiver of up to 10200 on unemployment benefits.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

As we all know a provision in 3rd stimulus bill mentioned tax relief of first 10200 unemployment benefits.

. The legislation allows taxpayers who earned less than 150000 in adjusted gross income to exclude unemployment compensation up to 20400 if married filing jointly or. Call the IRS at 1-800-829-1040 during their support hours. How to speak directly to an IRS agent.

Under the American Rescue Plan signed into law Thursday the IRS will make the first 10200 in unemployment benefits from 2020 tax-free. At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax. If you received unemployment benefits last yearyou may be eligible for a refund from the IRS.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020. The amount of the refund will vary per person depending on overall. Saturday June 4 2022.

Not the amount of the refund. ARPA allows eligible taxpayers to exclude up to 10200 of unemployment compensation on their 2020 income tax return. The 10200 tax break is the amount of income exclusion for single filers.

-10200 Unemployment Tax Break if it says amending refund 2020 under your federal taxes is that how much you are getting back. The first10200 in benefit income is free of federal income tax per legislation. The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits.

Extra refund checks for 10200 unemployment tax break will start going out in May The first refunds are expected to be made in May and will continue into the summer the IRS. Check For the Latest Updates and Resources Throughout The Tax Season. If you earned less than 150000 in modified adjusted gross income you can exclude up to 10200 in.

And this tax break only applies to 2020. The unemployment compensation exclusion was updated across all TurboTax platforms online. Select your language pressing 1 for English or 2 for Spanish.

Only up to the first 10200 of unemployment compensation is not taxable for an individual. The exemption which applied to federal taxes meant that unemployment checks sent during the pandemic werent counted as earned income. How can you tell if Turbo Tax is including the 10200 unemployment tax break.

Refund for unemployment tax break. COVID-19 stimulus package. The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person.

So far the refunds are averaging. THE IRS is now sending 10200 refunds to millions of Americans who have paid unemployment taxes. This means you dont have to pay tax on unemployment compensation of up to 10200 on your 2020 tax return only.

The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits. For married taxpayers separate exclusions can.

Say it says 8305 i am so lost with this. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits.

What are the unemployment tax refunds. If your modified adjusted gross income AGI is less than 150000 the. President Joe Biden signed the pandemic relief law in.

32 votes 34 comments. Irs unemployment tax break refund status. Signed on March 11 the 19 trillion American Rescue Plan exempts from federal tax up to 10200 of unemployment benefits received in 2020 or 20400 for married couples.

Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit. Around 10million people may be getting a payout if they filed their tax. Yes Fourth Stimulus Check Update Irs Tax Refunds 10 200 Unemployment In 2021 Tax Refund Irs Taxes Checks.

The latest 19 trillion stimulus package creates a new tax break.

Indian Shares End Flat Private Lenders Fall While Reliance Metal Stocks Gain Private Lender Financial Stocks Initial Public Offering

Deere Co 2021 Annual Report 10 K

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Kiddie Tax On Unearned Income H R Block

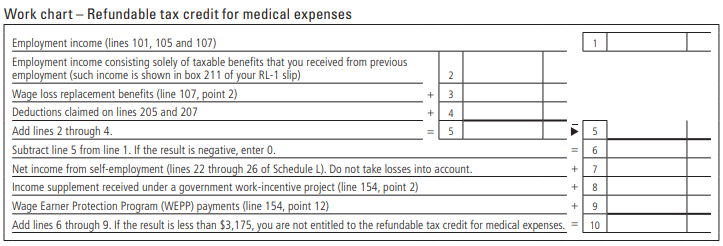

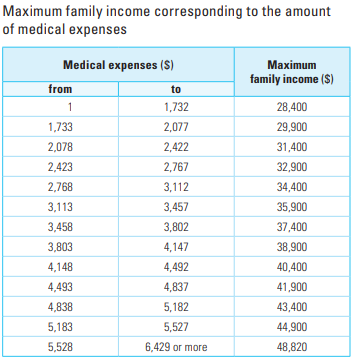

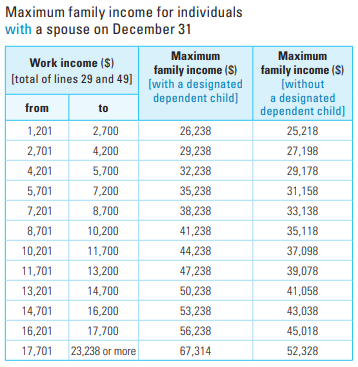

How Much Is The Footlockers Tax If Shoes Are 170 Bucks I Live In Canada Quora

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Loan Payment Spreadsheet Personal Financial Planning Financial Planning Financial Plan Template

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

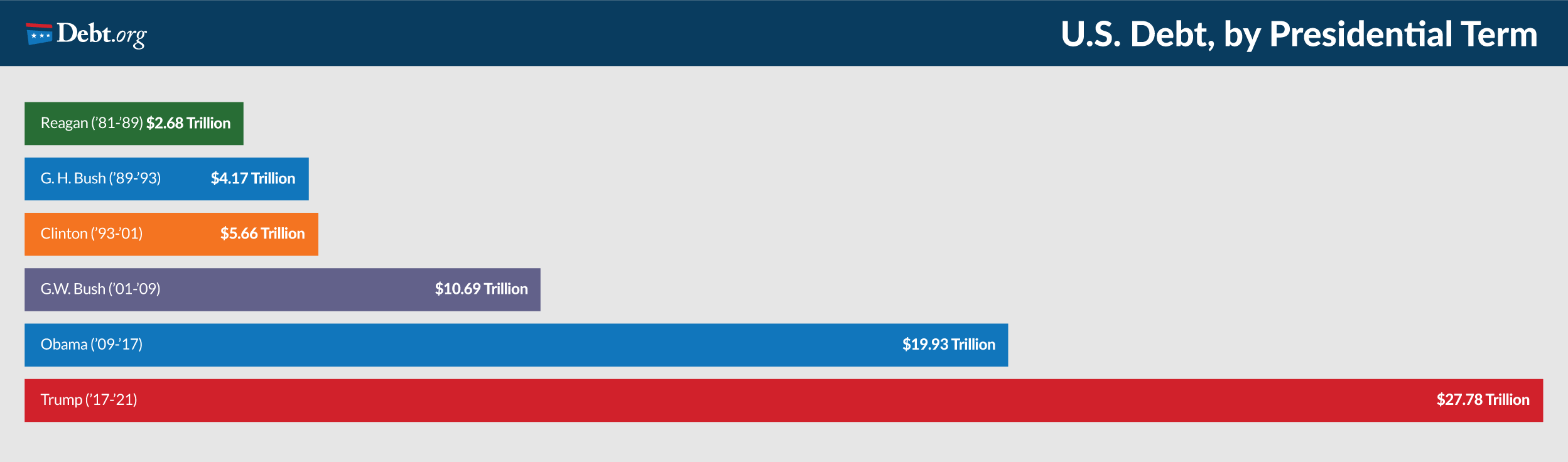

History Of Debt In The United States

The Average Canadian Family Spends About 43 Of Its Income On Taxes Why Is Income Tax So High In Canada Quora

The Cares Act The Tax Provisions And What S Next

Can The Irs Take Or Hold My Refund Yes H R Block

Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status

Another Blow To Working People During The Pandemic States Snatching Back Tax Refunds Center For Public Integrity